5 Cs of Credit - What Lenders Look At

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

5 Cs of Credit - What Lenders Look At

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

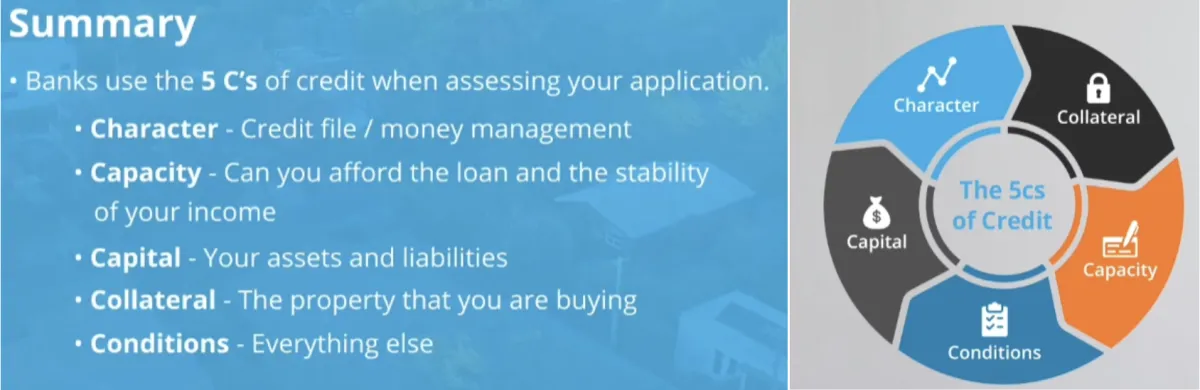

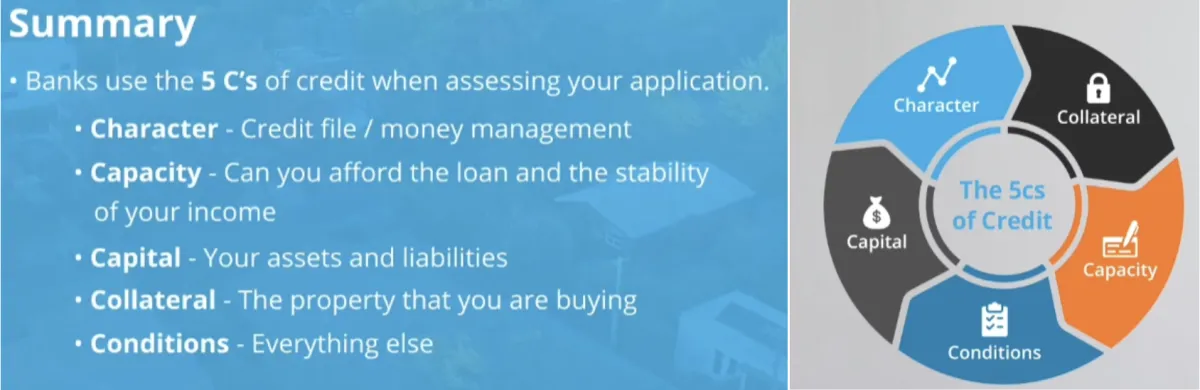

How Lenders Assess Your Home Loan Application

Before approving a home loan, lenders evaluate five key factors—Character,

Capacity, Capital, Collateral, and Conditions—known as the 5 Cs of Credit.

These factors determine your borrowing power, loan terms, and overall loan

eligibility.

Understanding the 5 Cs of Credit is essential for first-home buyers and

property investors. Knowing how lenders assess your loan application can

increase your chances of mortgage approval, help you qualify for better interest

rates, and strengthen your financial position.

Let’s break down each of the 5 Cs and how you can optimize them to improve

your home loan approval chances.

1. Character – Your Credit Score & Financial Conduct

Character refers to your creditworthiness, which lenders assess through your

credit score and credit history. Your credit file serves as a character certificate

of how you handle financial obligations.

Even if you’re not planning to buy a property right now, keeping your credit record

clean is crucial because:

Some jobs require a credit check.

You may need a good credit history for utility connections (e.g., internet, phone

plans).

How Your Credit File is Created in Australia

Your credit file is automatically activated the first time you take out a loan, credit

card, or utility connection in your name.

Australia follows a Comprehensive Credit Reporting (CCR) system, meaning

both positive and negative repayment activity affects your credit score.

Missed or late repayments will negatively impact your credit history.

What Negatively Affects Credit Scores:

Late or missed payments (even small bills like phone or internet plans).

Defaults on loans.

High credit card balances (even if not maxed out).

Not having a credit history (lenders can’t assess risk).

How to Build a Strong Credit Profile

If you’re wondering how to improve your credit score, follow these steps:

Ensure utility bills and phone plans are in your name to start building a credit

history.

If employed, consider a low-limit credit card and always pay it off on time.

Request a free annual credit report at Equifax.com.au

Avoid unnecessary credit card applications before applying for a home loan.

Did You Know?

Having no credit history is better than bad credit history!

If you’re new to Australia or haven’t taken loans before, lenders will assess other financial factors instead.

2. Capacity – Can You Afford the Loan?

Capacity refers to your ability to repay a mortgage based on your income,

financial obligations, and spending habits.

What Lenders Look At When Assessing Your Borrowing Capacity

Stable Income – Full-time salary is preferred, but casual & self-employed income

may be discounted.

Existing Debts – Personal loans, car loans, credit card limits, and Buy Now Pay

Later (BNPL) reduce your borrowing power.

Debt-to-Income Ratio (DTI) – A lower DTI ratio (typically below 6) improves loan

approval chances.

Household Expenses – Banks use Household Expenditure Measures (HEM) to

estimate minimum living costs.

Tips to Increase Your Borrowing Capacity

Reduce existing debts before applying for a mortgage.

Increase your income by exploring promotions, overtime, or secondary income.

Lower unnecessary expenses (streaming services, dining out, impulse purchases).

Work with a mortgage broker to get a more accurate serviceability assessment.

Pro Tip

If you’re thinking of switching jobs, talk to a mortgage broker first!

Some lenders won’t count income earned during a probation period or may require a longer work history for certain roles.

3. Capital – How Much Money Do You Need Upfront?

Capital refers to the funds required upfront to secure a property. Many first-home

buyers focus only on the deposit, but lenders consider all related costs.

Capital Requirements for Home Buyers

Deposit – Typically 5-20% of the property price.

Stamp Duty – Costs vary by state; first-home buyers may be eligible for exemptions

or concessions.

Lender’s Mortgage Insurance (LMI) – Required if borrowing more than 80% of the

property’s value.

Moving Costs, Renovations & Emergency Fund – Always budget for unexpected costs.

How to Plan Your Capital Requirements Effectively

Aim for a 20% deposit to avoid LMI fees

Check government grants & first-home buyer incentives to reduce upfront costs

Work with a mortgage broker to calculate exact capital needs before house hunting.

Many buyers focus only on the deposit, but hidden costs (stamp duty, legal fees) can

add thousands to the amount you need upfront. Planning ahead ensures you're financially

prepared for the full cost of buying a home.

4. Collateral – The Property as Loan Security

Collateral refers to the property you are buying, which acts as security for the loan. If you

default on the loan, the lender has the right to sell the property to recover their funds.

What Types of Properties Are Accepted as Collateral?

Houses, townhouses, or apartments in major cities & metro areas.

Freehold properties with clear titles and no legal issues.

What Properties May Be Rejected?

Small apartments (<40 sqm) – Lenders may require a higher deposit.

Rural & Acreage Properties – Some banks won’t approve these.

Flood Zone, Fire-Prone, or High-Risk Areas – Lenders may decline these properties.

Off-the-Plan & New Developments – Some lenders only approve after construction is

completed.

How to Avoid Property Collateral Issues

Before bidding at an auction, ask your mortgage broker to review the property listing.

Ensure the property meets lender criteria before making an offer.

Important: Pre-approval doesn’t include property assessment. Winning an auction

doesn’t guarantee your loan will be approved for that specific property.

5. Conditions – Loan Terms & Special Lender Policies

Conditions cover everything else lenders consider before granting loan approval.

Common Loan Conditions That Impact Approval

Loan Purpose – Is it for an owner-occupied or investment property?

Employment Type – Probation periods, contract jobs, and casual work may reduce

approval chances

Visa Status – Some lenders have restrictions on temporary visa holders.

Investment Property Rental Income – Some lenders require minimum rental income

levels.

Strata Levies & Property Risks – Can impact serviceability calculations.

How to Avoid Loan Condition Issues

Check lender-specific policies before applying.

Review conditions with your broker to avoid surprises.

Get a fully assessed pre-approval, not just a quick online approval.

Fast pre-approvals aren’t always reliable. Many banks use automated assessments

that don’t verify all

documentation. This can lead to loan rejection later when a full review is done.

Summary: Strengthen Your Loan Application with the 5 Cs of Credit

Before applying for a home loan, make sure you are strong in all 5 areas:

Character – Keep a high credit score and avoid excessive credit applications.

Capacity – Maintain steady income & low debt levels.

Capital – Save a large enough deposit & factor in extra costs.

Collateral – Ensure the property meets lender requirements.

Conditions – Check for special lending restrictions before applying.

Keep Exploring Your Home Loan Knowledge

You’ve unlocked the secrets to borrowing capacity, but there’s more to the puzzle!

Your Loan-to-Value Ratio (LVR) can shape your loan approval, interest rates, and even

extra costs like Lenders Mortgage Insurance (LMI).

What’s the magic number lenders love? Find out here:

A high LVR could mean extra costs, while a low LVR can save you thousands.

Find out why lenders care so much about this number.

Related Topics

A one-time fee that protects the lender when your home loan deposit is less than 20%. It helps you buy a property sooner with a smaller deposit.

Buying property comes with legal work — but who should you hire? We break down what conveyancers and solicitors do, their key differences, and how to choose the right one for your situation.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

What’s Next?

Understanding How Lenders Assess Your Creditworthiness

You now understand borrowing capacity, but how do banks actually judge a borrower?

Discover the 5 key factors lenders evaluate before approving a loan.

Read Next:

A high LVR could mean extra costs, while a low LVR can save you thousands. Find out why lenders care so much about this number.

Related Topics

A one-time fee that protects the lender when your home loan deposit is less than 20%. It helps you buy a property sooner with a smaller deposit.

Buying property comes with legal work — but who should you hire? We break down what conveyancers and solicitors do, their key differences, and how to choose the right one for your situation.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

How Lenders Assess Your Home Loan Application

Before approving a home loan, lenders evaluate five key factors—Character, Capacity, Capital, Collateral, and Conditions—known as the 5 Cs of Credit. These factors determine your borrowing power, loan terms, and overall loan eligibility.

Understanding the 5 Cs of Credit is essential for first-home buyers and property investors. Knowing how lenders assess your loan application can increase your chances of mortgage approval, help you qualify for better interest rates, and strengthen your financial position.

Let’s break down each of the 5 Cs and how you can optimize them to improve your home loan approval chances.

1. Character – Your Credit Score & Financial Conduct

Character refers to your creditworthiness, which lenders assess through your credit score and credit history. Your credit file serves as a character certificate of how you handle financial obligations.

Even if you’re not planning to buy a property right now, keeping your credit record clean is crucial because:

Some jobs require a credit check.

You may need a good credit history for utility connections (e.g., internet, phone plans).

How Your Credit File is Created in Australia

Your credit file is automatically activated the first time you take out a loan, credit card, or utility connection in your name.

Australia follows a Comprehensive Credit Reporting (CCR) system, meaning both positive and negative repayment activity affects your credit score.

Missed or late repayments will negatively impact your credit history.

What Negatively Affects Credit Scores:

Late or missed payments (even small bills like phone or internet plans).

Defaults on loans.

High credit card balances (even if not maxed out).

Not having a credit history (lenders can’t assess risk).

How to Build a Strong Credit Profile

If you’re wondering how to improve your credit score, follow these steps:

Ensure utility bills and phone plans are in your name to start building a credit history.

If employed, consider a low-limit credit card and always pay it off on time.

Request a free annual credit report at Equifax.com.au

Avoid unnecessary credit card applications before applying for a home loan.

Did You Know?

Having no credit history is better than bad credit history!

If you’re new to Australia or haven’t taken loans before, lenders will assess other financial factors instead.

2. Capacity – Can You Afford the Loan?

Capacity refers to your ability to repay a mortgage based on your income, financial obligations, and spending habits.

What Lenders Look At When Assessing Your Borrowing Capacity

Stable Income – Full-time salary is preferred, but casual & self-employed income may be discounted.

Existing Debts – Personal loans, car loans, credit card limits, and Buy Now Pay Later (BNPL) reduce your borrowing power.

Debt-to-Income Ratio (DTI) – A lower DTI ratio (typically below 6) improves loan approval chances.

Household Expenses – Banks use Household Expenditure Measures (HEM) to estimate minimum living costs.

Tips to Increase Your Borrowing Capacity

Reduce existing debts before applying for a mortgage.

Increase your income by exploring promotions, overtime, or secondary income.

Lower unnecessary expenses (streaming services, dining out, impulse purchases).

Work with a mortgage broker to get a more accurate serviceability assessment.

Pro Tip

If you’re thinking of switching jobs, talk to a mortgage broker first!

Some lenders won’t count income earned during a probation period or may require a longer work history for certain roles.

3. Capital – How Much Money Do You Need Upfront?

Capital refers to the funds required upfront to secure a property. Many first-home buyers focus only on the deposit, but lenders consider all related costs.

Capital Requirements for Home Buyers

Deposit – Typically 5-20% of the property price.

Stamp Duty – Costs vary by state; first-home buyers may be eligible for exemptions or concessions.

Lender’s Mortgage Insurance (LMI) – Required if borrowing more than 80% of the property’s value.

Moving Costs, Renovations & Emergency Fund – Always budget for unexpected costs.

How to Plan Your Capital Requirements Effectively

Aim for a 20% deposit to avoid LMI fees

Check government grants & first-home buyer incentives to reduce upfront costs

Work with a mortgage broker to calculate exact capital needs before house hunting.

Many buyers focus only on the deposit, but hidden costs (stamp duty, legal fees) can add thousands to the amount you need upfront. Planning ahead ensures you're financially prepared for the full cost of buying a home.

4. Collateral – The Property as Loan Security

Collateral refers to the property you are buying, which acts as security for the loan. If you default on the loan, the lender has the right to sell the property to recover their funds.

What Types of Properties Are Accepted as Collateral?

Houses, townhouses, or apartments in major cities & metro areas.

Freehold properties with clear titles and no legal issues.

What Properties May Be Rejected?

Small apartments (<40 sqm) – Lenders may require a higher deposit.

Rural & Acreage Properties – Some banks won’t approve these.

Flood Zone, Fire-Prone, or High-Risk Areas – Lenders may decline these properties.

Off-the-Plan & New Developments – Some lenders only approve after construction is completed.

How to Avoid Property Collateral Issues

Before bidding at an auction, ask your mortgage broker to review the property listing.

Ensure the property meets lender criteria before making an offer.

Important: Pre-approval doesn’t include property assessment. Winning an auction doesn’t guarantee your loan will be approved for that specific property.

5. Conditions – Loan Terms & Special Lender Policies

Conditions cover everything else lenders consider before granting loan approval.

Common Loan Conditions That Impact Approval

Loan Purpose – Is it for an owner-occupied or investment property?

Employment Type – Probation periods, contract jobs, and casual work may reduce approval chances

Visa Status – Some lenders have restrictions on temporary visa holders.

Investment Property Rental Income – Some lenders require minimum rental income levels.

Strata Levies & Property Risks – Can impact serviceability calculations.

How to Avoid Loan Condition Issues

Check lender-specific policies before applying.

Review conditions with your broker to avoid surprises.

Get a fully assessed pre-approval, not just a quick online approval.

Fast pre-approvals aren’t always reliable. Many banks use automated assessments that don’t verify all

documentation. This can lead to loan rejection later when a full review is done.

Summary: Strengthen Your Loan Application with the 5 Cs of Credit

Before applying for a home loan, make sure you are strong in all 5 areas:

Character – Keep a high credit score and avoid excessive credit applications.

Capacity – Maintain steady income & low debt levels.

Capital – Save a large enough deposit & factor in extra costs.

Collateral – Ensure the property meets lender requirements.

Conditions – Check for special lending restrictions before applying.

Keep Exploring Your Home Loan Knowledge

You’ve unlocked the secrets to borrowing capacity, but there’s more to the puzzle!

Your Loan-to-Value Ratio (LVR) can shape your loan approval, interest rates, and even

extra costs like Lenders Mortgage Insurance (LMI).

What’s the magic number lenders love?

Find out here:

Related Topics

A one-time fee that protects the lender when your home loan deposit is less than 20%. It helps you buy a property sooner with a smaller deposit.

Buying property comes with legal work — but who should you hire? We break down what conveyancers and solicitors do, their key differences, and how to choose the right one for your situation.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

© 2025 Estate Seeker.com.au - All Rights Reserved. Content on this site is for educational purposes only.

Always consult with a professional before making any investment decisions.