Case 1 & Case 2 - Studies

Case 1 & Case 2 - Studies

Case 1 -Studies

Your Essential Auction Buyer Checklist

Eligible for 95% LVR = 95% Loan and 5% Deposit.

Borrowing Capacity of $300,000

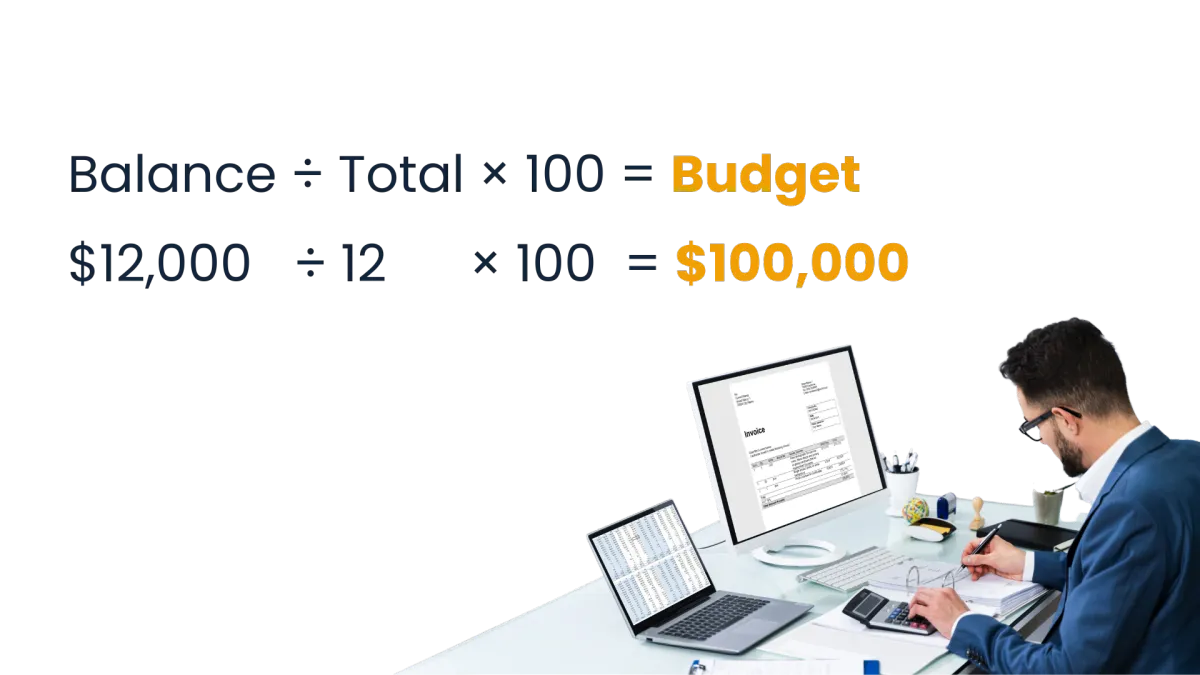

Step 1: Budget Calculation (Deposit Only)

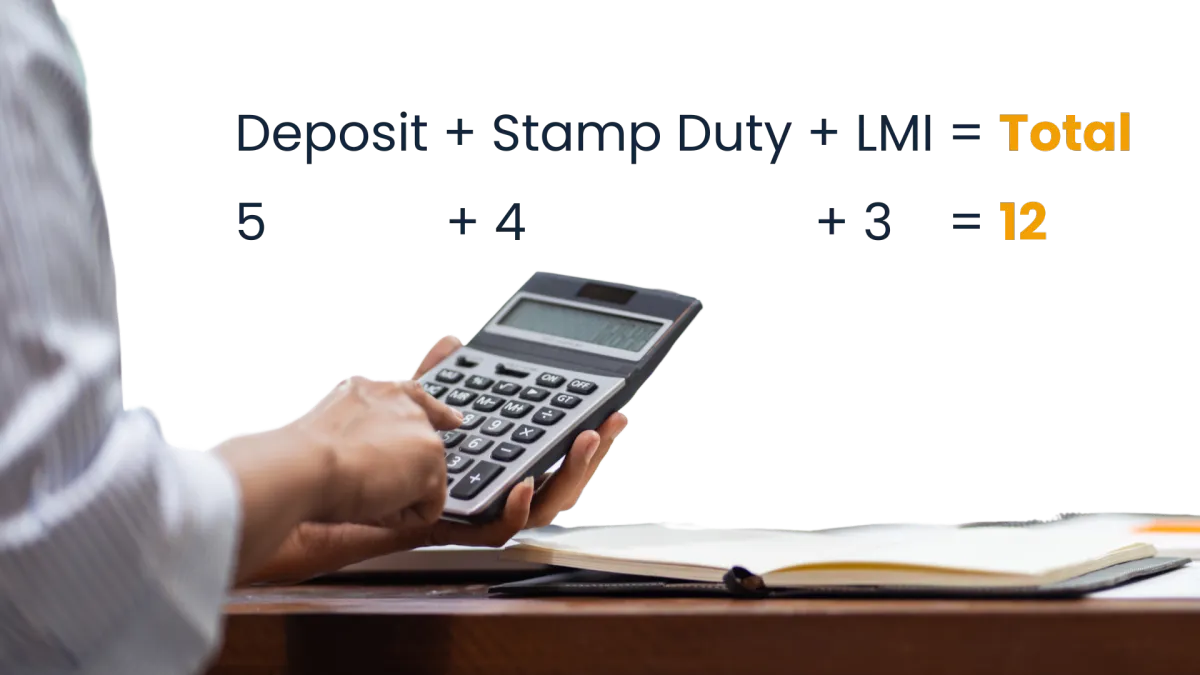

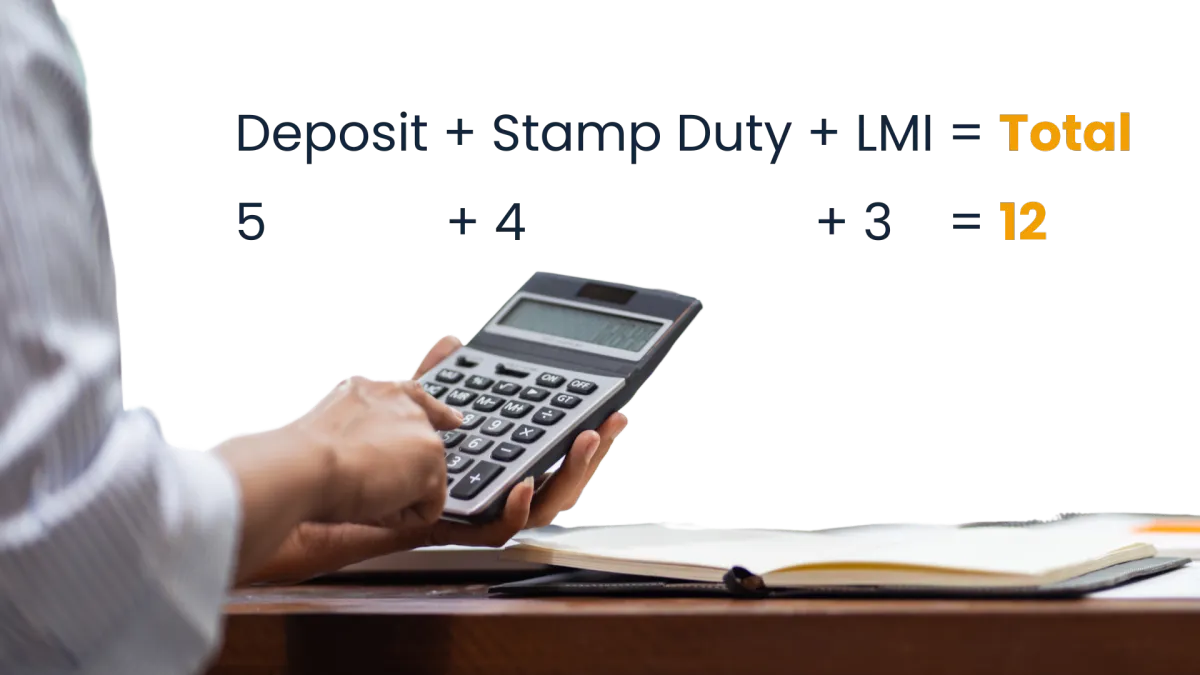

Step 2: Budget Calculation (Deposit + Stamp Duty + LMI = Total Costs)

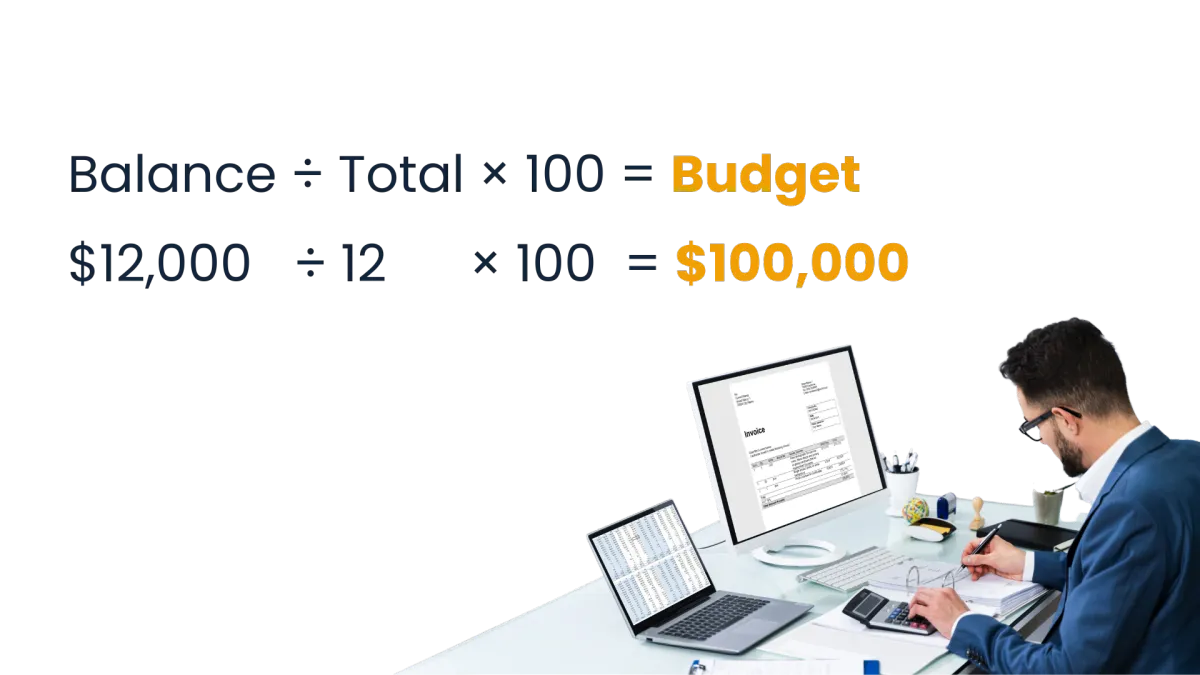

Step 3: Budget Calculation (Deposit + Costs)

Final Thought

While a 95% LVR loan boosts borrowing power, upfront costs like stamp duty and LMI can significantly reduce your real budget. In this case, even though the capacity suggests up to $240,000, factoring in all costs brings the realistic budget closer to $100,000. Careful planning ensures you don’t overestimate what you can comfortably afford.

Case 2 -Studies

Working out - Savings required

Eligible for 95% LVR = 95% Loan and 5% Deposit.

Borrowing Capacity of $300,000

Step 1: Budget Calculation (Based on Borrowing Capacity)

Step 2: Deposit Calculation

Step 3: Total Savings Required (Deposit + Expenses)

Final Thought

With a borrowing capacity of $300,000, the property value works out to about $315,789. To secure this, a buyer would need at least $20,790 in savings (deposit + expenses). On top of this, stamp duty and LMI may apply, making it essential to check for available exemptions or concessions to reduce upfront costs.

Case 1 -Studies

Your Essential Auction Buyer Checklist

Eligible for 95% LVR = 95% Loan and 5% Deposit.

Borrowing Capacity of $300,000

Step 1: Budget Calculation (Deposit Only)

Step 2: Budget Calculation (Deposit + Stamp Duty + LMI = Total Costs)

Step 3: Budget Calculation (Deposit + Costs)

Final Thought

While a 95% LVR loan boosts borrowing power, upfront costs like stamp duty and LMI can significantly reduce your real budget. In this case, even though the capacity suggests up to $240,000, factoring in all costs brings the realistic budget closer to $100,000. Careful planning ensures you don’t overestimate what you can comfortably afford.

Case 2 -Studies

Working out - Savings required

Eligible for 95% LVR = 95% Loan and 5% Deposit.

Borrowing Capacity of $300,000

Step 1: Budget Calculation (Based on Borrowing Capacity)

Step 2: Deposit Calculation

Step 3: Total Savings Required (Deposit + Expenses)

Final Thought

With a borrowing capacity of $300,000, the property value works out to about $315,789. To secure this, a buyer would need at least $20,790 in savings (deposit + expenses). On top of this, stamp duty and LMI may apply, making it essential to check for available exemptions or concessions to reduce upfront costs.

Related Topics

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

Buying your first home? Follow these must-do steps to stay prepared, avoid mistakes, and purchase with confidence.

Key experts—like brokers, solicitors, and inspectors—who guide and support you through every step of buying your first home.

A split loan lets you divide your mortgage into two parts—one fixed, one variable—so you can balance stability with flexibility.

Lenders may discount parts of your income—like bonuses or casual earnings—when assessing your borrowing power. This is known as “income shredding” or an “income haircut.”

The cooling-off period is a brief timeframe after signing a property contract when buyers can cancel the deal, often with little or no penalty.

Related Topics

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

Buying your first home? Follow these must-do steps to stay prepared, avoid mistakes, and purchase with confidence.

Key experts—like brokers, solicitors, and inspectors—who guide and support you through every step of buying your first home.

A split loan lets you divide your mortgage into two parts—one fixed, one variable—so you can balance stability with flexibility.

Lenders may discount parts of your income—like bonuses or casual earnings—when assessing your borrowing power. This is known as “income shredding” or an “income haircut.”

The cooling-off period is a brief timeframe after signing a property contract when buyers can cancel the deal, often with little or no penalty.

© 2025 Estate Seeker.com.au - All Rights Reserved. Content on this site is for educational purposes only.

Always consult with a professional before making any investment decisions.