Offset Account

Offset Account

What Is an Offset Account?

An offset account is a transaction account linked to your home loan that helps reduce the amount

of interest you pay.

Instead of earning interest like a regular savings account, the money in your offset account is

“offset” against your home loan balance when your interest is calculated.

How Does an Offset Account Work?

Let's say:

Your home loan balance is $500,000

You have $50,000 sitting in your offset account

👉 You’ll only be charged interest on $450,000 (not the full $500K).

Since interest is calculated daily and charged monthly, even having money in your offset account

for a few days can make a noticeable difference.

Key Benefits

Save thousands in interest over the life of your loan

Pay off your mortgage faster without changing your lifestyle

Access your money anytime like a normal bank account

Make your savings work harder instead of sitting idle

There’s no standard formula—and lenders won’t know the exact cost until

you request a payout figure

⚠️ Things to Watch Out For

Some offset accounts come with monthly fees

Not all lenders offer 100% offset — some may be partial

There may be minimum balance requirements to enjoy full benefits

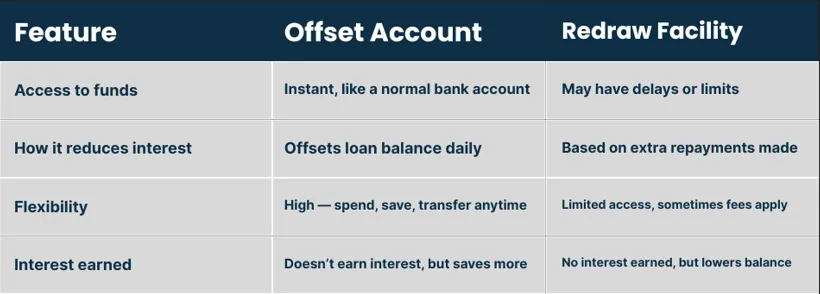

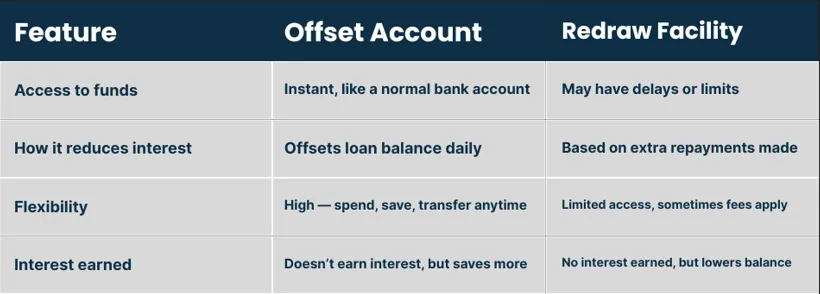

👉 Tip: Offset accounts give more flexibility, while redraw suits those who make extra repayments

and don’t need immediate access.

Fixed Rate Loans and Offset Accounts

Offset accounts are usually linked to variable rate home loans

Some lenders offer partial offset accounts with fixed rate loans

This means only part of your savings will be counted toward reducing interest

Always check with your broker or lender to see what options are available with your loan

type

👉 If you're on a fixed rate, ask specifically about partial offset or redraw options.

Who Is an Offset Account Best Suited For?

An offset account is ideal for:

People with regular income (e.g. salary goes into offset each month)

Borrowers with savings or lump sums

Property investors looking to manage tax-deductible interest and cash flow

Buyers who want to pay off their loan faster — without needing to make formal extra

repayments

An offset account is a powerful tool for reducing home loan interest and speeding up your

mortgage repayments. It’s especially helpful for borrowers who keep regular savings or cash

flow in their account.

Related Topics

Lenders may discount parts of your income—like bonuses or casual earnings—when assessing your borrowing power. This is known as “income shredding” or an “income haircut.”

The cooling-off period is a brief timeframe after signing a property contract when buyers can cancel the deal, often with little or no penalty.

A break fee (or break cost) is a charge you may incur for ending a fixed-rate loan before the agreed term.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

A high LVR could mean extra costs, while a low LVR can save you thousands. Find out why lenders care so much about this number.

An offset account is a transaction account linked to your home loan that helps reduce the amount of interest you pay.

Instead of earning interest like a regular savings account, the money in your offset account is “offset” against your home loan balance when your interest is calculated.

How Does an Offset Account Work?

Let's say:

Your home loan balance is $500,000

You have $50,000 sitting in your offset account

👉 You’ll only be charged interest on $450,000 (not the full $500K).

Since interest is calculated daily and charged monthly, even having money in your offset account for a few days can make a noticeable difference.

Key Benefits

Save thousands in interest over the life of your loan

Pay off your mortgage faster without changing your lifestyle

Access your money anytime like a normal bank account

Make your savings work harder instead of sitting idle

There’s no standard formula—and lenders won’t know the exact cost until

you request a payout figure

⚠️ Things to Watch Out For

Some offset accounts come with monthly fees

Not all lenders offer 100% offset — some may be partial

There may be minimum balance requirements to enjoy full benefits

👉 Tip: Offset accounts give more flexibility, while redraw suits those who make extra repayments and don’t need immediate access.

Fixed Rate Loans and Offset Accounts

Offset accounts are usually linked to variable rate home loans

Some lenders offer partial offset accounts with fixed rate loans

This means only part of your savings will be counted toward reducing interest

Always check with your broker or lender to see what options are available with your loan type

👉 If you're on a fixed rate, ask specifically about partial offset or redraw options.

Who Is an Offset Account Best Suited For?

An offset account is ideal for:

People with regular income (e.g. salary goes into offset each month)

Borrowers with savings or lump sums

Property investors looking to manage tax-deductible interest and cash flow

Buyers who want to pay off their loan faster — without needing to make formal extra repayments

An offset account is a powerful tool for reducing home loan interest and speeding up your mortgage repayments. It’s especially helpful for borrowers who keep regular savings or cash flow in their account.

Related Topics

Lenders may discount parts of your income—like bonuses or casual earnings—when assessing your borrowing power. This is known as “income shredding” or an “income haircut.”

The cooling-off period is a brief timeframe after signing a property contract when buyers can cancel the deal, often with little or no penalty.

A break fee (or break cost) is a charge you may incur for ending a fixed-rate loan before the agreed term.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

A high LVR could mean extra costs, while a low LVR can save you thousands. Find out why lenders care so much about this number.

© 2025 Estate Seeker.com.au - All Rights Reserved. Content on this site is for educational purposes only.

Always consult with a professional before making any investment decisions.