Understanding Principal and Interest (P&I) Home Loan Repayments

Learn how Principal and Interest (P&I) repayments work in Australian home loans, how they compare to interest-only loans, and what’s best for first home buyers and owner-occupiers.

Understanding Principal and Interest (P&I) Home Loan Repayments

Learn how Principal and Interest (P&I) repayments work in Australian home loans, how they compare to interest-only loans, and what’s best for first home buyers and owner-occupiers.

P&I - Principal and Interest Repayments

When taking out a home loan in Australia, one of the key decisions you’ll make is how you

want to structure your repayments. The most common option is a Principal and Interest (P&I)

loan. But what does that mean—and how does it impact your mortgage?

This guide breaks down everything you need to know about P&I home loans, how they work,

and how they compare to interest-only repayments.

P&I - Principal and Interest Repayments

When taking out a home loan in Australia, one of the key decisions you’ll make is how you want to structure your repayments. The most common option is a Principal and Interest (P&I) loan. But what does that mean—and how does it impact your mortgage?

This guide breaks down everything you need to know about P&I home loans, how they work, and how they compare to interest-only repayments.

What Are Principal and Interest Repayments?

Principal and Interest (P&I) repayments mean you’re paying off both:

The principal – the original loan amount you borrowed

The interest – the cost charged by the lender for borrowing the money

With P&I loans, each repayment reduces your loan balance and covers the interest owed.

Over time, you’ll pay down the debt and build equity in your property.

How Do P&I Loans Work in Australia?

In the early years of a P&I loan, a larger portion of your repayment goes toward interest.

As your loan balance decreases, more of your repayment goes toward reducing the principal.

Common in owner-occupier loans

Lower long-term cost compared to interest-only loans

Helps build equity faster

Usually required to avoid Lenders Mortgage Insurance (LMI) on high-LVR loans

What Are Principal and Interest Repayments?

Principal and Interest (P&I) repayments mean you’re paying off both:

The principal – the original loan amount you borrowed

The interest – the cost charged by the lender for borrowing the money

With P&I loans, each repayment reduces your loan balance and covers the interest owed.

Over time, you’ll pay down the debt and build equity in your property.

How Do P&I Loans Work in Australia?

In the early years of a P&I loan, a larger portion of your repayment goes toward interest.

As your loan balance decreases, more of your repayment goes toward reducing the principal.

Common in owner-occupier loans

Lower long-term cost compared to interest-only loans

Helps build equity faster

Usually required to avoid Lenders Mortgage Insurance (LMI) on high-LVR loans

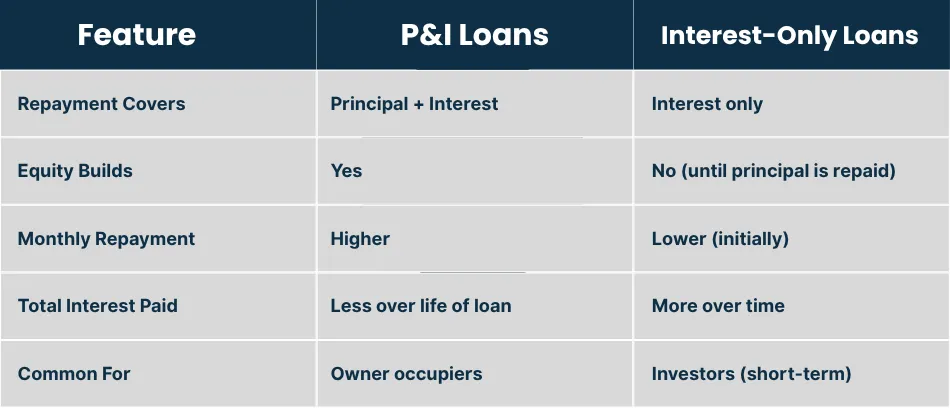

P&I vs Interest-Only Loans

When Should You Choose a P&I Loan?

A Principal and Interest loan is generally the best option if:

You're buying your own home to live in

You want to reduce your loan faster

You want to avoid paying more in interest over the long term

It’s often the default loan type offered by lenders to first home buyers and owner-occupiers in Australia.

Can You Switch Between P&I and Interest-Only?

Yes, in most cases you can apply to switch. However, lenders may reassess your financial situation before

approving the change, and interest-only periods are usually time-limited (e.g. 5 years).

Want to Estimate Your P&I Repayments?

Contact Win Square Finance to find the right loan structure for your goals—and get expert guidance

every step of the way.They can help you calculate your monthly repayments based on your loan amount,

interest rate, and term.

Want to Estimate Your P&I Repayments?

Contact Win Square Finance to find the right loan structure for your goals—and get expert guidance every step of the way.

They can help you calculate your monthly repayments based on your loan amount,

interest rate, and term.

Related Topics

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

A one-time fee that protects the lender when your home loan deposit is less than 20%. It helps you buy a property sooner with a smaller deposit.

A high LVR could mean extra costs, while a low LVR can save you thousands. Find out why lenders care so much about this number.

Buying a home? Stamp duty can add a big chunk to your costs. We break down what it is, how much you’ll pay, and when you might score an exemption or discount.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

Related Topics

Discover the five key factors lenders evaluate when assessing loan applications and learn how each plays a role in securing mortgage approval.

A one-time fee that protects the lender when your home loan deposit is less than 20%. It helps you buy a property sooner with a smaller deposit.

A high LVR could mean extra costs, while a low LVR can save you thousands. Find out why lenders care so much about this number.

Buying a home? Stamp duty can add a big chunk to your costs. We break down what it is, how much you’ll pay, and when you might score an exemption or discount.

Understand how lenders determine your borrowing power and what factors impact loan approval. Learn how to improve your eligibility and maximise your home loan options.

© 2025 Estate Seeker.com.au - All Rights Reserved. Content on this site is for educational purposes only.

Always consult with a professional before making any investment decisions.